Homeowners Insurance in and around Atlanta

Looking for homeowners insurance in Atlanta?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Being a homeowner isn’t always easy. You want to make sure your home and the possessions in it are protected in the event of some unexpected loss or mishap. And you also want to be sure you have liability insurance in case someone hurts themselves on your property.

Looking for homeowners insurance in Atlanta?

Apply for homeowners insurance with State Farm

Why Homeowners In Atlanta Choose State Farm

If you're worried about handling the unexpected or just want to be prepared, State Farm's high-quality coverage is right for you. Producing a policy that works for you is not the only aspect that agent Will Mobley can help you with. Will Mobley is also equipped to assist you in filing a claim if something does happen.

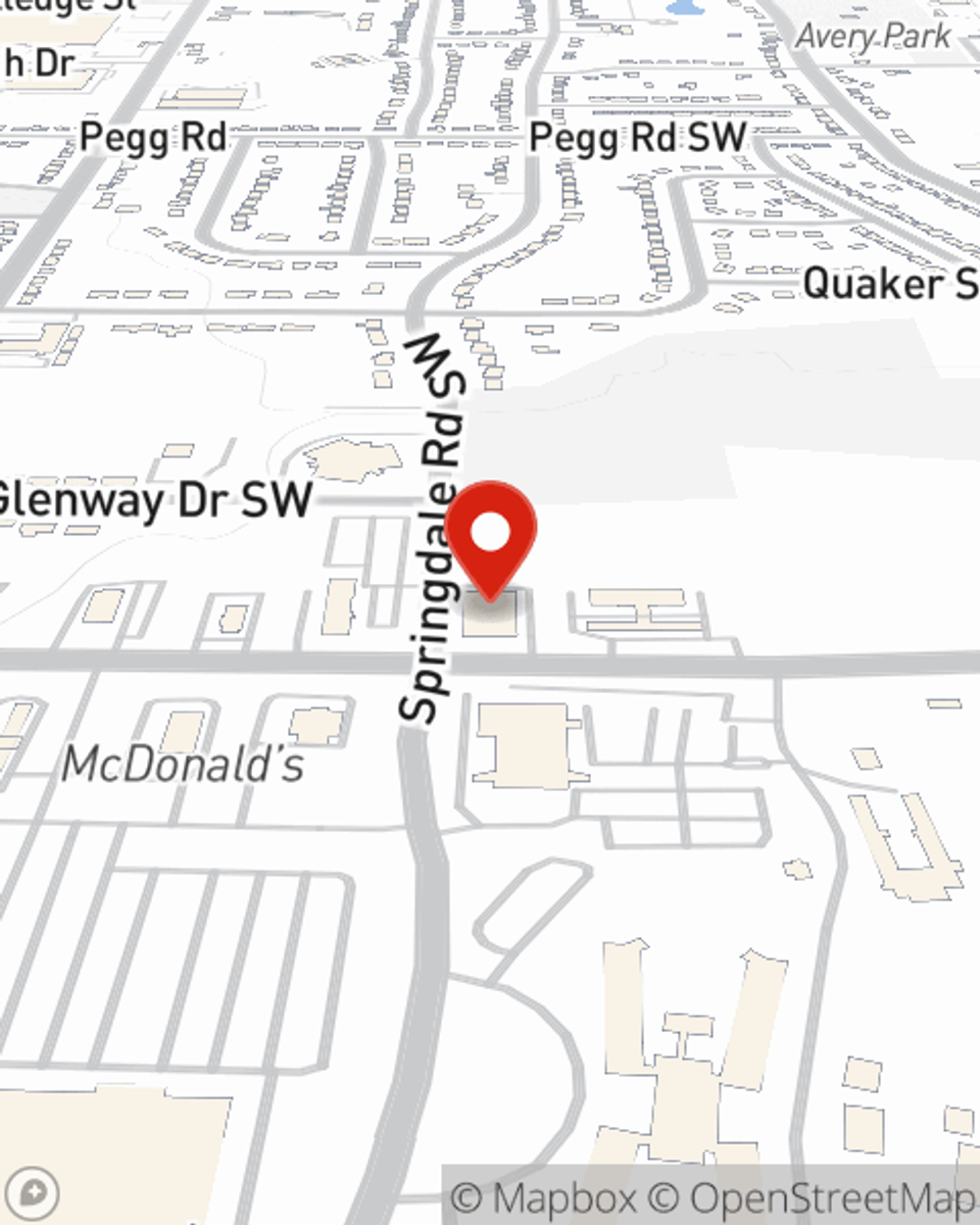

Atlanta, GA, it's time to open the door to dependable insurance. State Farm agent Will Mobley is here to assist you in understanding the policy that's right for you. Get in touch today!

Have More Questions About Homeowners Insurance?

Call Will at (470) 867-3269 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

How to protect your digital footprint

How to protect your digital footprint

Reduce your digital footprint, when visiting a website or entering info online, by minimizing the data you leave behind so that it’s not misused by others.

Will Mobley

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

How to protect your digital footprint

How to protect your digital footprint

Reduce your digital footprint, when visiting a website or entering info online, by minimizing the data you leave behind so that it’s not misused by others.